Did you know a good tenant screening can cut down on rental defaults by up to 30%? As a landlord, finding dependable tenants is key to keeping your investment safe. It's important to have solid rental guide strategies in today's competitive market.

.webp)

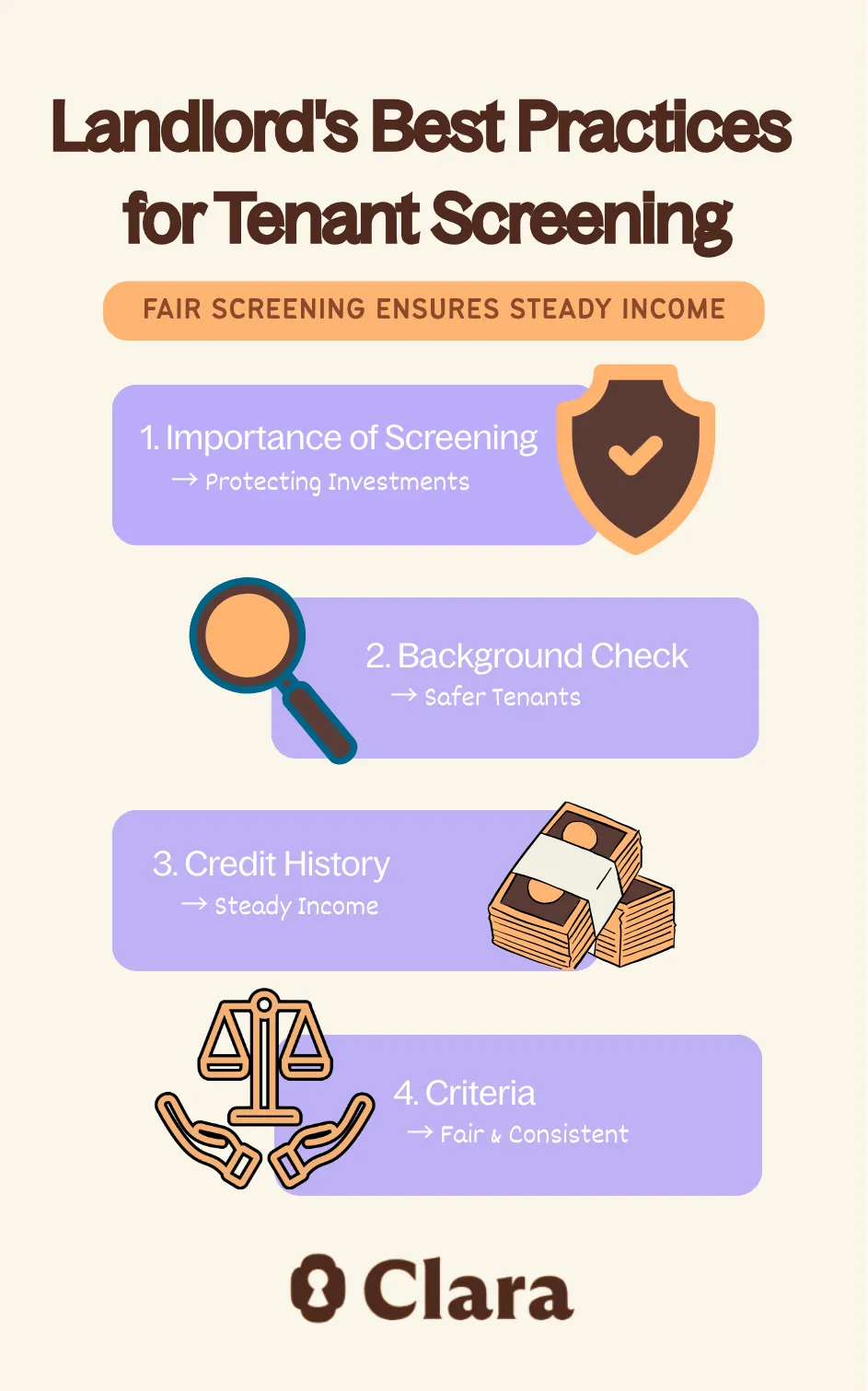

A detailed background check and credit history review are crucial for a strong tenant screening process. By following landlord best practices, you can lower risks and keep your income steady.

"The true cost of tenant screening isn't measured in application fees or background check expenses—it's measured in the quality of relationships you build with your residents. When implemented thoughtfully, screening isn't about exclusion but about setting the foundation for successful tenancies where both parties understand expectations from day one. The most effective property managers see screening as the first step in resident care, not just risk management. This perspective shift transforms screening from a defensive tactic into a strategic investment in community stability and long-term portfolio health."

Taylor Wilson, CEO of Rent with Clara

As a landlord, it's vital to have a good tenant screening process. This helps protect your rental investment. It ensures you find tenants who pay on time and take good care of the property.

Your rental property is a big investment. Effective tenant screening is essential to keep it safe. It helps you avoid damage and unpaid rent by choosing the right tenants.

A thorough tenant background check can greatly reduce problem tenants and evictions. It lets you spot issues early. This saves you from legal and financial troubles that come with evictions.

Rent payments are crucial for any rental business. Good tenant screening attracts tenants who are financially stable and pay on time. This is key for a steady income and less stress in property management.

By focusing on effective tenant screening, landlords can make their rental business more stable and profitable. It's not just about filling spots. It's about finding tenants who respect the property and pay their rent.

To avoid risks, successful landlords use strong renter screening practices. They follow a detailed process. This includes a standard application, clear criteria, fair fees, and pre-screening tenants.

A standard application process is fair and consistent. It should ask for important details like rental history and credit score. This way, landlords can compare applicants fairly, avoiding discrimination claims.

For example, a good application form might ask for:

Landlords need clear criteria to evaluate tenants well. They should set specific, measurable standards that match their goals. This could be a minimum credit score or income level.

According to a guide on successful tenant screening, clear criteria help landlords make fair decisions. It also ensures they follow fair housing laws.

Application fees are needed for background checks and credit reports. Landlords should charge fair fees that follow local laws. It's important to be clear about these fees and not discriminate against applicants.

"The key to a successful tenant screening process is transparency and fairness. By being upfront about your criteria and fees, you can attract reliable tenants and minimize disputes."

John, Rental Property Expert

Pre-screening helps landlords weed out unqualified applicants. This can be done through initial phone or online checks. Landlords can quickly assess a tenant's suitability based on basic criteria.

By following these best practices, landlords can find reliable tenants. It's about creating a fair, efficient, and effective screening process for everyone's benefit.

Tenant screening costs are a critical investment that every property owner must factor into their rental business model. These expenses typically include rental application fees, credit report charges ($15-30 per applicant), criminal background checks ($10-25), and eviction history searches ($5-15).

While screening services to evaluate potential tenants may seem expensive upfront, they represent a fraction of what problem tenants could cost in lost rent, property damage, and eviction proceedings.

Property owners should establish a clear screening policy that balances thoroughness with cost-effectiveness in today's competitive rental market. Many landlords charge applicants reasonable application fees (typically $25-75) to cover basic screening expenses, though these fees must comply with local regulations.

The key is implementing efficient screening processes that help identify quality tenants without creating unnecessary financial barriers that might deter responsible and reliable tenants from applying.

Smart landlords view tenant screening costs as an essential business expense that protects their successful rental property investments. By investing in comprehensive screening upfront, property owners can avoid the much higher costs associated with problem tenants, including lost rent, legal fees, and property repairs that can easily exceed thousands of dollars.

Tenant background checks are key in the rental process. They help landlords make smart choices. A detailed check can show if a tenant is reliable and right for the rental.

Looking at a credit report is crucial. It shows a tenant's financial past, like their credit score and payment history. This helps landlords see if renting to someone is risky.

Key elements to look for in a credit report include:

Criminal background checks are also vital. Landlords need to focus on crimes that matter for renting. For example, violent or property damage crimes are more important than small offenses.

Remember, following Fair Housing Laws is crucial when screening for crimes. For more on this, check out this guide on tenant screening services.

Checking a tenant's past with landlords is helpful. It reveals how they acted as a tenant. This includes their payment record, the property's state, and any problems.

Key questions to ask previous landlords include:

Checking a tenant's job and income is important. Landlords want to make sure they can afford the rent.

Key elements to verify include:

Analyzing a tenant screening report requires careful attention to detail and understanding of what constitutes acceptable rental criteria. Property owners should systematically review each screening report section, looking beyond just credit scores to evaluate the complete financial picture, including debt-to-income ratios, payment patterns, and any recent financial hardships.

The goal is to evaluate potential tenants fairly while identifying those most likely to become responsible and reliable tenants who will contribute to a positive rental experience.

Rental history checks and establishing positive relationships with previous landlords are particularly valuable for tenant selection, as they provide insights into how applicants have treated rental properties in the past. When conducting tenant background screening, document all findings clearly and maintain consistent rental criteria across all applicants to ensure fair treatment and legal compliance.

Proper documentation of your screening policy and decision-making process protects against potential discrimination claims while helping you learn more about tenant background patterns that indicate quality tenants. Keep detailed records of how you evaluate potential tenants, including specific reasons for approval or denial decisions, as this documentation becomes crucial if your tenant selection process is ever questioned legally.

Landlords need to know the legal rules of tenant screening to follow the law and avoid problems. The rules for screening tenants vary by state and area.

Fair housing laws say you can't discriminate based on race, color, or other things. Landlords must treat all applicants the same to avoid being accused of discrimination.

The Fair Credit Reporting Act (FCRA) controls how you use background checks for tenants. You must tell applicants clearly and get their permission before doing checks.

For more info on FCRA, check out Understanding Tenant Screening Laws.

Landlords also have to follow state laws on tenant screening. These laws might cover things like application fees, security deposits, and lease agreement details.

If you decide not to rent to someone, you must follow certain steps. You need to tell them why and give them info about their rights under the FCRA.

Creating a detailed tenant screening process is key for managing rental properties well. By using the best practices, landlords can find trustworthy tenants and safeguard their investments.

A good screening system ensures steady rent payments, lowers the chance of bad tenants, and cuts down on evictions.

To make a strong tenant screening system, landlords need to set clear criteria, check income and jobs, and do deep background checks. It's also vital to follow fair housing laws, like those in the FCRA. For more help on screening tenants, check out Good Life Management's blog on the topic.

By using a systematic and legal approach to screening tenants, landlords can make the rental application smoother, lower risks, and build better relationships with tenants. This leads to a successful and profitable rental property management journey.